Half-Yearly Residential Market Update

Inner and Middle Melbourne, April 2020

Note: It is important to note that this Half-Yearly Residential Market Update is based on data available at the time of publication (April 2020). Melbourne market conditions are changing dramatically in response to COVID-19 and will continue to change in coming weeks and months. At this stage in the pandemic, reliable data on these market changes are not yet available. This report is therefore based on data prior to the COVID-19 outbreak. Any commentary related to the impact of COVID-19 should be considered in context of significant market uncertainty, and is speculative in nature.

What is the Residential Development Index (RDI)?

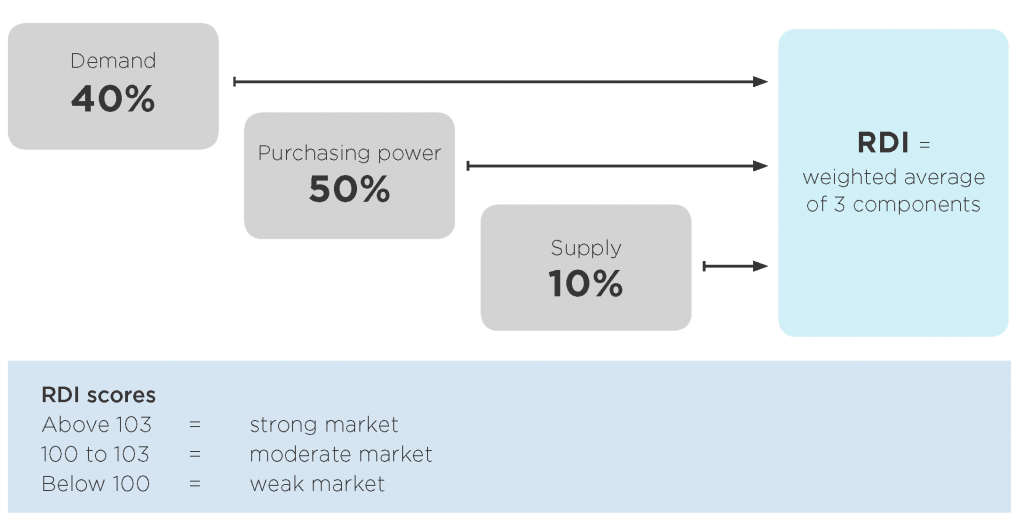

The RDI measures the health of Victoria’s residential development industry on an ongoing basis.

It examines the dynamics impacting the industry, including economic conditions, population growth, development activity, trend data, regulatory changes and policy implications. These industry activity fundamentals inform the RDI, which determines whether the industry is operating in a strong, moderate or weak market, relative to recent and long history.

RDI and Advocacy

The RDI is a core plank of UDIA Victoria’s advocacy strategy. We rely on it daily to brief key decision-makers on the health of the industry, and to demonstrate the impact of policy and regulatory changes on the economy and the general public.

The RDI key findings have strengthened UDIA Victoria’s calls for:

- Action to address the declining supply of new housing, including the re-introduction of stamp duty incentives for investors and the removal of tax surcharges for foreign purchasers;

- Focus on promoting Victoria as an investment destination for the property and development industries and take early steps to outline industry’s role in major infrastructure projects including the Suburban Rail Loop so that planning controls and value capture mechanisms are known early and investment can be made with certainty;

- Continue to address post-planning delivery constraints by working with state agencies, service delivery authorities and local government, to enable the development industry to convert land supply into new lots for housing in our growth areas; and

- Undertake an evidence-based review of built form design controls including the Central City built form controls and the Better Apartment Design Standards to assess their cost impost and affordability impacts of any proposed changes.