Stamp duty concessions to support the apartment sector have been overshadowed by three tax hikes that will exacerbate housing stress right across the board.

“Today’s Budget provides over $50 million in support for homebuyers, but strips $2.4 billion from the same people.” – Matthew Kandelaars, CEO UDIA Victoria

CEO Message.

Today’s Budget confirms what we’ve known since last weekend – that our industry, and Victorian homebuyers, will be asked to carry the burden to balance the State’s books.

The increases to Stamp Duty and Land Tax rates, and the proposed Rezoning Tax, will collect $2.4 billion over the next four years.

In better news, the Budget does include the lifting of the Land Tax-free threshold to $300,000, and targeted stimulus to support the CBD apartment market.

Ordinarily, we would applaud these advocacy wins but this is difficult in a Budget that sends mixed messages and takes much more from our industry than it delivers – our industry is paying $2.4 billion in additional taxes for a $54 million return.

UDIA Victoria modelling prepared by Urban Enterprise and released today shows that the proportion of a home purchase price attributed to government taxes, fees and charges will rise from 28 per cent to 42 per cent if Stamp Duty and Land Tax rates are increased and a Rezoning Tax is introduced. This means a $600,000 apartment in Melbourne’s inner or middle ring will include $253,500 in government taxes and charges (an increase of nearly $90,000).

Read the breaking story on p. 6 of today’s The Australian, or online here.

We’re not taking these tax hikes lying down. UDIA Victoria is using our new research to urge the Government to reconsider the tax changes. We’re also using the research to influence cross-bench MPs to block the changes, which need to be passed by the Parliament to take effect.

Please read on for further detail on today’s 2021/22 Victoria State Budget, to learn more about what we’re doing to fight the tax increases, and to be part of real advocacy in action.

Sincerely,

Matthew Kandelaars

CEO, UDIA Victoria

2021 Budget: At a Glance.

Key Economic Data

- Economic Overview

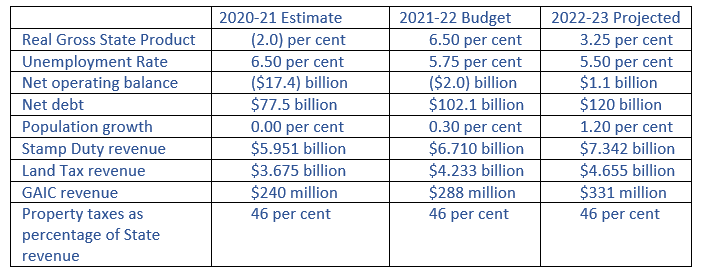

- The 2020-21 Victorian State Budget will deliver an operating deficit of $17.4b in 2020-21 and a forecast deficit of $2.0b in 2021-22, rising to a forecast surplus of $1.1b in 2022-23.

- Victoria’s GSP is forecast to increase by 6.5 per cent in 2021-22, following a decline of 2.0 per cent in 2020-21.

- Population

- Victoria’s population growth is expected to grow slightly in 2021-22, rising further by 1.2 per cent in 2022-23, as international borders are expected to open.

- Employment

- The unemployment rate is expected to continue to improve, from 6.5 per cent in 2020-21, to 5.75 per cent in 2021-22 and 5.5 per cent in 2022-23.

Property Taxation

Taxes on our industry now represent approximately 46% of the State Government’s taxation revenue, meaning our industry pays nearly 50 cents in every dollar the Government earns.

- Land Transfer Duty (Stamp Duty)

The Budget includes significant changes to Stamp Duty, including:- An increase in Stamp Duty from 5.5 to 6.5 per cent on “premium” property transactions with dutiable value over $2m, effective July 2021.

- Advocacy win: Stamp Duty concessions have been provided to support the CBD apartment sector:

- Temporary increase in the eligibility threshold for the off-the-plan duty concession: The threshold for the off-the-plan stamp duty concession will increase to $1m for all homebuyers who call the home their principal place of residence (for contracts entered into from 1 July 2021 to 30 June 2023). The dutiable value of the property can be up to $1m.

- Temporary stamp duty concession for new residential property within the Melbourne local government area: A Stamp Duty concession of up to 100 per cent will be provided on the purchase of new residential property, in the Melbourne local government area, with a dutiable value of up to $1m.

- For new residential property that has been unsold for less than 12 months since completion, a 50 per cent concession will be provided (for contracts entered into from 1 July 2021 to 30 June 2022).

- Purchases of a new property that has been unsold for 12 months or more since completion will be exempt from duty. The exemption/concession will apply to the duty otherwise payable, exc. foreign purchaser additional duty (for contracts entered into from 21 May 2021 to 30 June 2022) .

- Stamp Duty is expected to recover by 12.7 per cent in 2021-22 and continue to rise across the forward estimates, reflecting a rebound in Victoria’s property market since public health restrictions have been progressively eased, combined with record low interest rates and strong housing sentiment.

- Land Tax

- The Budget includes an increase to Land Tax from January 2022:

- For holdings between $1.8m and $3m, there will be an increase of 0.25 per cent on the amount above $1.8m (to become $9375 plus 1.55 per cent of the amount above $1.8m); and

- For holdings above $3m, there will be an increase of 0.30 per cent (to become $24,975 plus 2.55 per cent of the amount above $3m).

- Advocacy win: The Land Tax-free threshold will increase from $250,000 to $300,000. This means for land not held on trust, Land Tax will only be payable if the total taxable value of the land is equal to or exceeds $300,000.

- Advocacy win: From 1 January 2022, the Vacant Residential Land Tax exemption for new developments will be extended for up to two years.

- Land tax revenue in 2021-22 is expected to increase by 15.2 per cent to $4.2b after a rise of 6.6 per cent in 2020-21.

- Land tax revenue is expected to grow by an average of 9 per cent a year over the forward estimates.

- The Budget includes an increase to Land Tax from January 2022:

- Growth Area Infrastructure Contributions

- The Budget estimates GAIC revenue to recover by 20 per cent to $288m for 2021-22.

- Forward GAIC estimates expect an additional $331m in 2022-23, $364m in 2023-24, and $383m in 2024-25.

- New Rezoning Tax

The Budget introduces a new Rezoning Tax, effective from July 2022 which includes:- For value uplifts between $100,001 to 500,000, a tax rate of 62.5 per cent of the uplift above $100,000; and

- For value uplifts above $500,000, a tax rate of 50 per cent of the total uplift.

- Areas subject to the Growth Area Infrastructure Charge will be excluded.

Planning Systems Investment

The Budget includes:

- More than $28m invested in the State’s planning systems;

- $21m for the Victorian Planning Authority to invest in its Streamlining for Growth program; and

- $6.6m invested into the ongoing implementation of Plan Melbourne.

NEW Rezoning Tax from July 2022: Further Details.

The Victorian Government is calling this Rezoning Tax a “Windfall Gains Tax”. UDIA Victoria refuses to adopt this misleading term, given the new tax is not simply applicable to those making “massive windfall profits overnight”, as the Government suggests. The tax will in fact hit regional markets, and infill and urban renewal sites including projects rezoned to provide affordable and social housing.

The Budget introduces a new Rezoning Tax to apply from July 2022. Unlike the increase to Land Tax and Stamp Duty, which will go through Parliament as part of the Budget Bill, the Rezoning Tax will have its own separate legislation to go through Parliament at a later date. This means we have a critical opportunity to negotiate the terms of the Rezoning Tax, making it a key advocacy priority for UDIA Victoria.

The new Rezoning Tax regime includes:

- A tax-free threshold for value uplifts up to $100,000;

- For value uplifts between $100,001 to 500,000, a tax rate of 62.5 per cent of the uplift above $100,000; and

- For value uplifts above $500,000, a tax rate of 50 per cent of the total uplift.

The tax will be able to be deferred to the next transaction. Areas subject to the Growth Area Infrastructure Charge will not be impacted.

The tax is payable on rezonings across Victoria except on rezonings to and from the Urban Growth Zone within existing Growth and Infrastructure Contribution areas, and rezonings to Public Land Zones. The tax applies to rezonings between zone types rather than between zone sub-categories.

Oustanding Questions

There are many more questions than answers on the mechanics and implementation of the Rezoning Tax. The truth is, much of the detail is yet to be developed by the Government. We have received many questions from our members, which we will be seeking responses to and which will inform our advocacy as we highlight the perverse outcomes this tax will have on housing supply and affordability.

Advocacy Campaign: What Can You Do?

UDIA Victoria continues to fight these the tax hikes that feature in today’s State Budget. We have been in constant communication with the Government, Opposition, cross-bench MPs and media. We have also been communicating with the Commonwealth, including the Assistant Treasurer’s office. We have further meetings scheduled throughout this week and early next week to continue to put the case forward on behalf of our industry.

More than ever, our advocacy needs your help spreading our message.

- ALERT CROSS-BENCH MPs: Let the cross-bench members of the Legislative Council know that Victorian families don’t deserve higher property taxes that will worsen housing affordability, and ask them to block the changes.

Encourage your contacts, suppliers and customers to do the same. You can find out who your local MP is and how to contact them by clicking here. Select your suburb next to ‘Electorate’ and press search for your local MP’s contact details.

- SOCIAL MEDIA: Let homebuyers know where their money is going. Homebuyers deserve to know they could pay over 40% of their home price to government if today’s Budget passes the Parliament. For those who use social media, click here to access a graphic that we encourage you to post. If you see someone else post this, please like and share. You can also like and share UDIA Victoria’s post via LinkedIn here. The more we spread this message, the more people will begin to take notice, especially from outside our industry, and the more the Government will feel the pressure.

It’s been a disappointing week, but the journey has just begun and UDIA Victoria is on the case. We’ve got your back.