UDIA Victoria’s flagship research publication, the Residential Development Index (RDI), measures the current health of the industry and reviews the impacts of the pandemic and border closures on Victorian population growth, and the flow-on effects for the residential construction sector.

As Victoria adjusts to living with COVID-19, the economy has shifted to a situation where demand is now exceeding supply, although this is softening.

With limited land supply, the current housing affordability crisis has only been exacerbated by the increased cost of living and a returning populace, in turn significantly impacting the viability of the market in Victoria.

The latest UDIA Residential Development Index (RDI) provides a breakdown of Victoria’s housing trends and economic forecasting for the development industry.

Summary of key points: RDI 2022

Overview / Context

UDIA Victoria’s flagship research publication, the Residential Development Index (RDI), measures the current health of the industry and reviews of the impacts of the pandemic and border closures on Victorian population growth, and the flow-on effects for the residential construction sector.

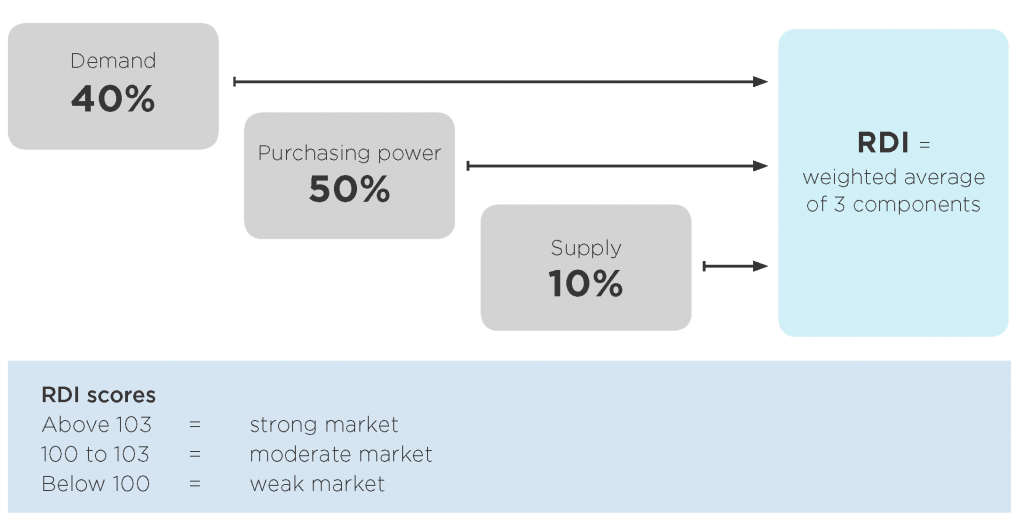

We’ve examined industry drivers such as population growth, economic conditions, development activity, building approvals, regulatory changes and policy. The RDI uses this information to determine whether the industry is operating in a strong, moderate or weak market, relative to recent and long-term history.

Key findings – General

- Victoria has recorded a remarkable turnaround in population growth with net overseas migration reaching 32,000 in the March quarter of 2022 and total population growth reaching 33,400.

- This has been partnered with a recovery in interstate migration over the next 12 months that could lead to overall population growth of well over 40,000 which would equate to 2019/20 levels.

The 2022 RDI research report includes a review of the impacts that supply chain constraints, labour force shortages & geopolitical ramifications have had on Victoria. These factors are extrapolated upon to forecast positive & negative drivers over the next 12 -24 months for the residential urban development industry.

Residential Development Index (RDI) Rating

- The RDI has experienced a significant decline in June 2022 to 100.2 from 102.4 in June 2021, which puts it below the 10-year average of 101.4, based on the updated methodology that now considers the cost of finance relative to mortgage sizes and incomes.

- Based on expected interest rates and budget forecasts for key variables in 2023 the index is expected to deteriorate further to 97.3.

- While the updated UDIA RDI is much less volatile than the previous measure, values above 100 are an indication of strong residential market and any value below 99 to be indicative of particularly harsh conditions.

- The index was at its lowest point in June 2011 (98.2) when the cost of finance was significantly higher than it is now however, relative loan sizes were lower.

- While there was a significant decline in the 2022 UDIA RDI, a further decline in 2023 is expected as interest rate increases continue to impact on activity.

Key market trends by region

- In the inner ring, building approvals continue to trend low for dwellings in inner Melbourne for FY21/22 with around 5,000 approvals consistent with levels in FY20/21. The past four years continue to be well below the volume of 13,467 dwelling approvals of FY17/18, with the overall trend shifting away from high rise / high volume projects.

- In the middle ring, total dwelling approvals for FY21/22 grew by 23 per cent and are now nearly 3 times the volume of building approvals of those in the Inner Ring. Approvals for apartments reached 6,045 trending toward the historically high volumes of 8,000 in FY17/18. Meanwhile, townhouse approvals were at record levels reaching 6,850 in the FY21/22 period.

- Total building approvals for Melbourne’s growth areas dwellings were 21,932 for FY 21/22 which represents significant decrease from FY20/21 but is still relatively high compared to historical averages.

- Regional Victoria’s total building approvals for dwellings for FY21/22 declined to 16,132, down from 20,197 in FY20/21, representing a return to longer term trends.

Conclusions

The impacts of living with COVID-19 and the knock-on effects of supply and labour shortages have left the market more susceptible a returning populace.

Given Victoria’s population growth is on target to reach 120,000 persons plus, building approvals will need to increase to 70,000 per annum or greater because a significant proportion of the existing building approval activity is in ‘one for one’ home replacement in established areas and townhouse development.

To provide affordable housing stock and support the cross-subsidisation of key worker and social housing projects, a medium-term increase in apartment supply back to volumes closer to 20,000 per annum is required. This will also assist in achieving the aspiration for 70 per cent of new housing development to be in established areas as outlined in Plan Melbourne, and in providing a moderation to rental and housing costs for key workers.

UDIA recommendation

The RDI addresses one of the key issues facing Victoria, demand without supply. Increasing land supply will make the largest impact towards challenging the growing housing affordability crisis in Victoria. Land prices continue to break through record barriers as the market further constrains against this shrinking supply of zoned and unzoned land. Victoria is barrelling towards an exhausted stock meaning the already exacerbated prices will only continue to increase without immediate action.

RDI and Advocacy

The RDI is a core plank of UDIA Victoria’s advocacy strategy. We rely on it daily to brief key decision-makers on the health of the industry, and to demonstrate the impact of policy and regulatory changes on the economy and the general public.

The 2022 RDI confirms that while there are several issues beyond the control of the Victorian Government, it is critical for the overall economy that support for the residential development sector becomes a top priority to support and bolster the State’s recovery.

Further stock must become available to counter the growing housing affordability crisis emerging in Victoria as more people continue to be priced out of the market as demand significantly outstrips supply.

What is the Residential Development Index (RDI)?

The RDI measures the health of Victoria’s residential development industry on an ongoing basis.

It examines the dynamics impacting the industry, including economic conditions, population growth, development activity, trend data, regulatory changes and policy implications. These industry activity fundamentals inform the RDI, which determines whether the industry is operating in a strong, moderate or weak market, relative to recent and long history.