UDIA Victoria’s flagship research publication, the Residential Development Index (RDI), measures the current health of the industry and reviews the impacts of the pandemic and border closures on Victorian population growth, and the flow-on effects for the residential construction sector.

The 2020 research into the health of the residential development sector has detailed significant headwinds ahead of the industry in the absence of immigration and population growth in the next two years, showing that the demand for new housing and employment in the residential development industry will be significantly reduced if immigration and population inflows are delayed until late 2022.

Up until March 2020, Victoria’s population was growing by around 115,000 people per year, which was generating a need for around 55,000 to 60,000 new homes per year. This level of activity sustained 194,400 jobs which are critically important to the Victorian economy.

Depending on when immigration normalises, the research shows that over the next few years the demand for new homes could halve to around 20,000 to 30,000 new homes per year, and jobs in the residential development industry could plummet by 20,000 per year.

The RDI details how the residential development sector was somewhat buffered from the full impact of COVID-19 through 2019/20, in part due to the positive impact of the HomeBuilder and JobKeeper programs, and the Victorian Government’s stimulus measures.

Further, the Andrews’ Government’s commitment to Social and Affordable Housing will see delivery of $3.2 billion in dwelling investment over four years from 20/21. This will support around 12,000 new dwellings, or approximately 3,000 per year, offsetting around 15 to 20% of the expected decline in private sector stock volumes.

Another factor is that job losses haven’t hit the typical home buying cohort who purchase new dwellings, and have mainly fallen on young people who aren’t yet forming families and are primarily still renting.

Additionally, market demand is still being driven by population growth flowing from 2017 to 2019.

Residential Development Index (RDI) Rating at June 2020: 100.3

The RDI has experienced a marginal increase in June 2020 to 100.3 up from 100.1 in June 2019 which remains below the 10-year average of 101.9. However, the RDI is forecasted to decrease to a historically low 94.6 throughout the 12 months to June 2021.

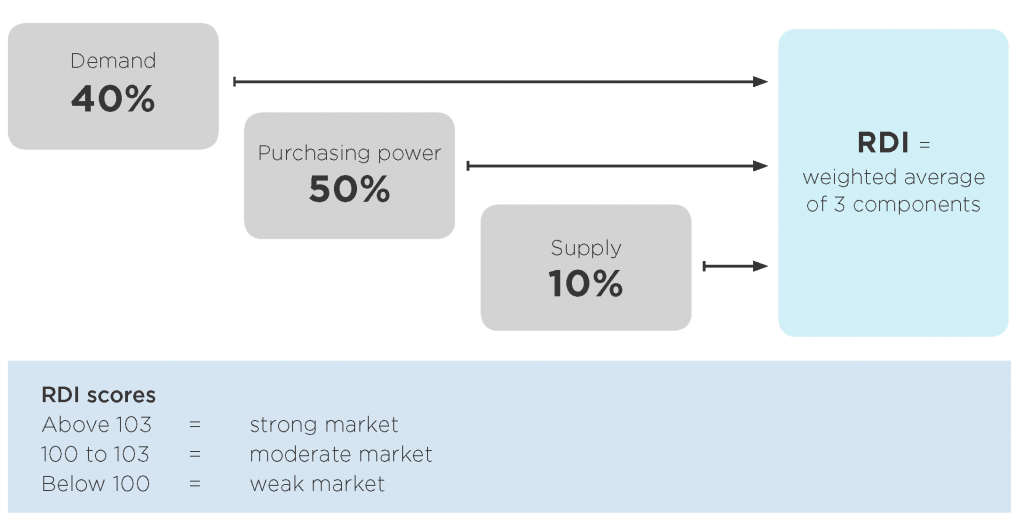

Based on historical data, an RDI of 100 or higher indicates a relatively well performing sector with results above 103 indicating strong drivers in the sector. Results below 100 indicate relative weakness or emerging weakness in key drivers.

Summary of key points: 2020 RDI

Overview / Context

UDIA Victoria’s flagship research publication, the Residential Development Index (RDI), measures the current health of the industry and reviews of the impacts of the pandemic and border closures on Victorian population growth, and the flow-on effects for the residential construction sector.

We’ve examined industry drivers such as population growth, economic conditions, development activity, building approvals, regulatory changes and policy. The RDI uses this information to determine whether the industry is operating in a strong, moderate or weak market, relative to recent and long-term history.

Key findings – General

- Up until March 2020, Victoria’s population was growing by around 115,000 persons per year, which was generating a need for around 55,000 to 60,000 new homes per year.

- Depending on when immigration normalises, over the next few years the demand for new homes could fall to around 20,000 to 30,000 new homes per year (i.e. half).

- Jobs in the residential development industry could fall by an average of 20,000 jobs per year over 3 years.

The 2020 RDI research report includes a review of the impacts of the pandemic and border closures on Victoria, and presents two possible scenarios for the state’s economic recovery, based on analysis of what population growth, demand for homes, and jobs will look like if immigration recommences late next year, as opposed to what we’re facing if immigration is delayed until late 2022.

Post-COVID scenario 1: Immigration recommences late 2021

- Under UDIA Victoria’s first post-COVID scenario, international migration would recommence in late 2021, with a gradual return of international students in early 2022. Population growth would begin to normalise in 2022/23 and reach pre-COVID-19 levels in 2023/24.

- This scenario is considered optimistic yet realistic, and will lead to the loss of up to 150,000 new residents over the next three financial years, while dwelling demand could be reduced by 60,000 to 70,000 dwellings over three years.

- This scenario would lead to a large reduction of economic output over a three-year period in the order of $30 billion, or an average of $10 billion per year.

- Victoria’s residential development sector will be hit hard, with direct employment losses averaging 20,000 jobs per year over a three-year period, and wider job losses in other sectors.

Post-COVID Scenario 2: Immigration delayed until late 2022

- UDIA Victoria’s second scenario assumes that international migration is delayed until late 2022. This would see Victoria’s population growth remain at an annualised rate of 30,000 persons per year until late 2022.

- Under this scenario, interstate migration would remain subdued over the next two years due to weak economic growth in Victoria and nationally, with population growth beginning to recover in 2022/23, and dwelling demand increasing in 2023/24 and normalising in 2024/25.

- This scenario, with its prolonged weak population growth, could lead to a halving of residential dwelling demand for a period of up to four years. This would lead to the loss of demand equivalent to nearly 100,000 dwellings.

Residential Development Index (RDI) Rating

- The RDI has experienced a marginal increase in June 2020 to 100.3 up from 100.1 in June 2019 which remains below the 10-year average of 101.9.

- The current RDI rating reflects the fact that the residential development sector has been somewhat buffered from the full impact of COVID-19 due to the positive impact of the HomeBuilder and JobKeeper programs, and the Victorian Government’s stimulus measures. Additionally, job losses haven’t hit the typical home buying cohort who purchase new dwellings and have mainly fallen on young people who aren’t yet forming families and are primarily still renting, while demand has been supported for first homebuyers and those upsizing to a second dwelling with a combination of government grants and more recently tax cuts in the form of stamp duty savings. Further, market demand is still being driven by population growth flowing from 2017 to 2019.

- The RDI is forecasted to decrease to a historically low 94.6 throughout the 12 months to June 2021.

- Based on historical data, an RDI of 100 or higher indicates a relatively well performing sector with results above 103 indicating strong drivers in the sector. Results below 100 indicate relative weakness or emerging weakness in key drivers.

Will the Victorian State Budget offset impacts?

The State Government’s commitment to Social and Affordable Housing will see delivery of $3.2 billion in dwelling investment over four years from 20/21. This will support around 12,000 new dwellings or approximately 3,000 per year, offsetting around 15 to 20% of the expected decline in private sector stock volumes.

Key market trends by region

- In the inner ring, building approvals grew significantly in FY19/20 but remain below longer-term trends, particularly in the City of Melbourne. Recent building approvals for high density projects may be at some risk of not commencing given current market uncertainty or could be delayed. It is expected that the apartment market will recover but in boutique, lower density projects initially, while higher density projects in the inner ring will require the return of a large volume of international students and immigrant populations who seek access to education and entertainment.

- In the middle ring, activity is down after several strong years of growth. Supply in the middle ring significantly eclipsed the inner ring in 16/17 and 17/18, however while the market is still larger, it is facing dramatic reductions in apartment activity and to a lesser extent townhouse supply.

- Activity in Melbourne’s growth areas remains remarkably stable averaging around 20,000 dwellings per annum over the last four years. It is expected that this strong activity will continue throughout 20/21 at the expense of other parts of Melbourne.

- Activity in regional Victoria remains robust. Dwelling approvals for FY19/20 has followed strong lot sales in FY17/18 and FY18/19, particularly in Greater Geelong, and recent results in the September Quarter 2020 have equated to a 25% over the year.

- Growth area and regional areas are both projected to deliver circa 20,000 building approvals for new houses, with the regional market trending to comprise 70% to 80% of the size of the total housing market, led by major regional centres including Bendigo, Ballarat and Geelong.

- Young buyers and renters will become more accepting of outer suburbs, growth areas and regions. They will seek more affordable housing as income certainty and income growth may take 5 to 7 years to normalise.

Conclusions

The impacts of a COVID induced recession are yet to be heavily felt across the broader residential market due to several factors. However, there are significant risks on the horizon that need to be managed. These include:

- The potential for a prolonged economic impact from low population growth with impacts on economic output and full-time employment in the sector of up to 20,000 direct jobs per annum;

- A significant shift in the volume of housing provided in established areas including the inner ring and parts of the middle ring which will compromise strategic planning objectives of 70% housing in established areas;

- A reduction in housing diversity with a medium-term shift in supply to townhouse and detached dwellings;

- A hollowing out in demand for housing in the inner ring if international students and international migration flows are delayed; and

- Potential impacts on buyer confidence in 2021 if unemployment rates remain elevated and economic recovery is delayed.

UDIA recommendation

The prospect of avoiding major impacts from a COVID recession in the residential sector will depend on decisions made by both Commonwealth and State governments in 2021, including extensions of demand support and mitigating the broader impacts of the removal of the JobKeeper scheme.

The demand support currently provided by the Commonwealth and State Government is likely to be required to be maintained in the medium term as population growth impacts play out over a number of years.

RDI and Advocacy

The RDI is a core plank of UDIA Victoria’s advocacy strategy. We rely on it daily to brief key decision-makers on the health of the industry, and to demonstrate the impact of policy and regulatory changes on the economy and the general public.

The 2020 RDI confirms that while there are several issues beyond the control of the Victorian Government, it is critical for the overall economy that support for the residential development sector is a top priority over the next two years to support and bolster the State’s recovery.

The prospect of avoiding major impacts from a COVID recession in the residential sector will depend on demand support, made by both Commonwealth and State governments in 2021, including extensions of tax exemptions from the State Government, and JobKeeper and HomeBuilder at a national level.

What is the Residential Development Index (RDI)?

The RDI measures the health of Victoria’s residential development industry on an ongoing basis.

It examines the dynamics impacting the industry, including economic conditions, population growth, development activity, trend data, regulatory changes and policy implications. These industry activity fundamentals inform the RDI, which determines whether the industry is operating in a strong, moderate or weak market, relative to recent and long history.