Summary of Key Findings

September Quarter 2019

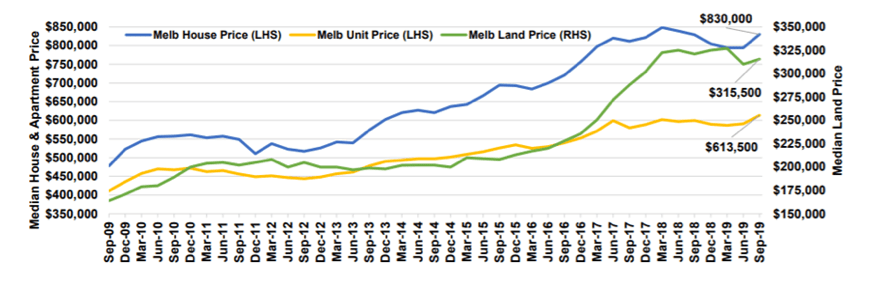

Melbourne Residential Market Prices

- A boost to borrowing capacity has resulted in more buoyant purchaser sentiment and encouraged buyers into the property market. Subsequent price increases have seen the median unit value reach a new peak and the median house value lift to just 2.2% below its previous high.

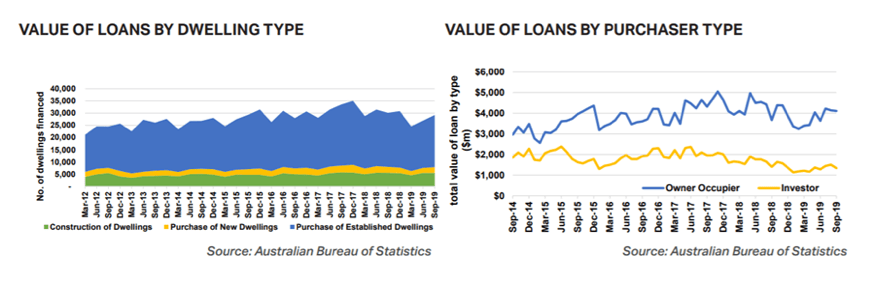

Finance Activity

- The number of new owner occupier loans increased by 8.6% in the quarter.

- The total value of new owner occupier loans increased by 12.4% over the quarter.

- The total value of new loans to investors increased by 12.6% over the quarter. The return of dwelling price growth and improved outlook for capital growth prospects has enticed some investors back to the market, hoping to purchase at the beginning of an upturn cycle in the property market. However, the value of new investor loans was still 10.8% lower than the same quarter in 2018.

- The number of first home buyer loans increased by 10.2% over the quarter.

- The number of non-first home buyers loans increased by 7.9% over the quarter. Both trade up and trade down buyers have started to enter the market, encouraged to sell their existing dwelling by the rebound in dwelling prices. However, the volume of loans in the three month period is still relatively low and 7.7% down on the same quarter in 2018.

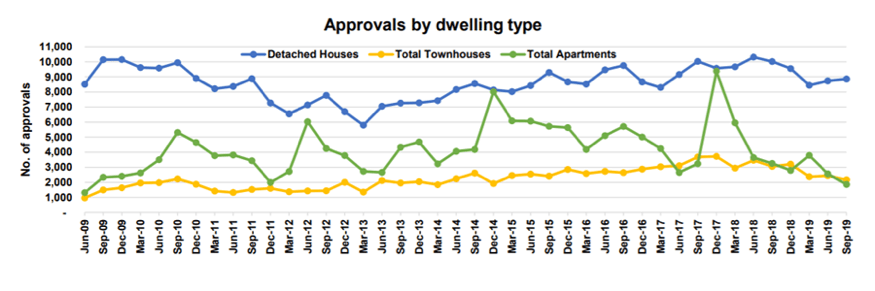

Building Activity

- Victorian dwelling approvals decreased by 21% from the same quarter in 2018.

- Total approvals during the 12 months to September 2019 were 24.3% lower compared to the 12 months to September 2018.

- New detached house approvals reduced by 11.6% on approvals from the same quarter in 2018. This was the lowest level of approval activity for detached houses for a September quarter in five years and is in response to the substantial fall in lot sales from the second half of 2018.

- Townhouse approvals contracted by 28.7% in September quarter 2019, compared to the same quarter in 2018. This is the fifth consecutive quarter where townhouse approvals have recorded a double-digit annual fall.

- Wyndham and Melton were two of only three municipalities in Melbourne to record a rise in medium density dwelling approvals over the year to September 2019, highlighting the increased prevalence of townhouse development in greenfield areas.

- Victoria recorded its lowest quarterly total for flats/units/apartments in buildings of 4 storeys or higher in over six years.

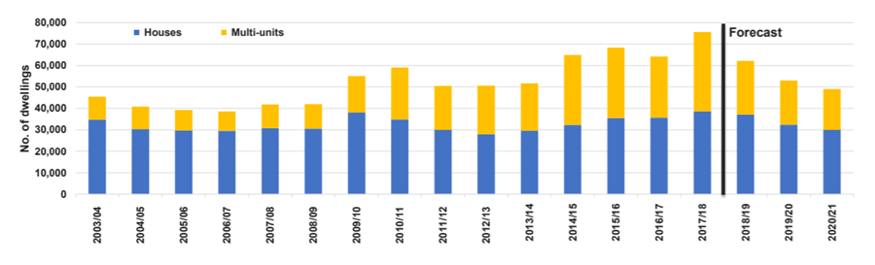

Commencements

- Construction levels are forecast to fall 19% over the following two years to 2020/21.

- Over the following two years to 2020/21, multi-unit dwelling commencements are projected to decrease by 23.8%. This will be the lowest level of construction activity in more than a decade, since 2009/10.

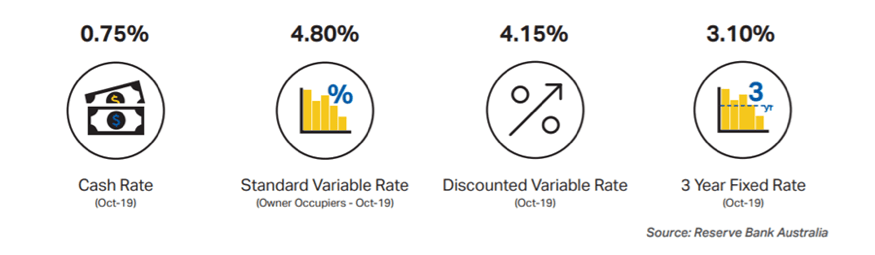

Interest Rates

- The outlook for family finances deteriorated despite the boost it received from the three interest rate reductions and tax relief for low and middle income earners. However, interest rate reductions did initiate a recovery in property markets, leading to considerably improved house price expectations.

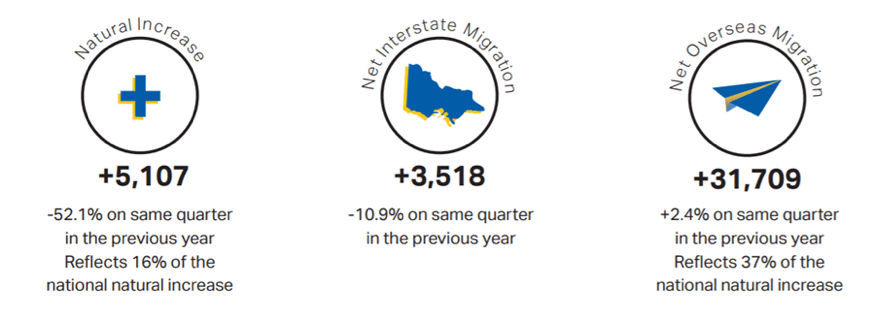

Population Components

- Victoria gained 40,334 people during March quarter 2019 (latest available data), lifting its estimated resident population to 6,566,170 people. This equated to a population increase of 133,515 people or 2.08% growth in Victoria over the 12 months to March 2019, which were both the strongest in absolute terms and percentage terms among all states and territories.

The Urban IQ Property Market reports are produced for UDIA Victoria by RPM Real Estate Group.

The reports provide a quarterly update on the Victorian residential market including economic activity, prices, finance, building, sentiment and affordability metrics.

To access the full Urban IQ reports, please login to your UDIA member account.